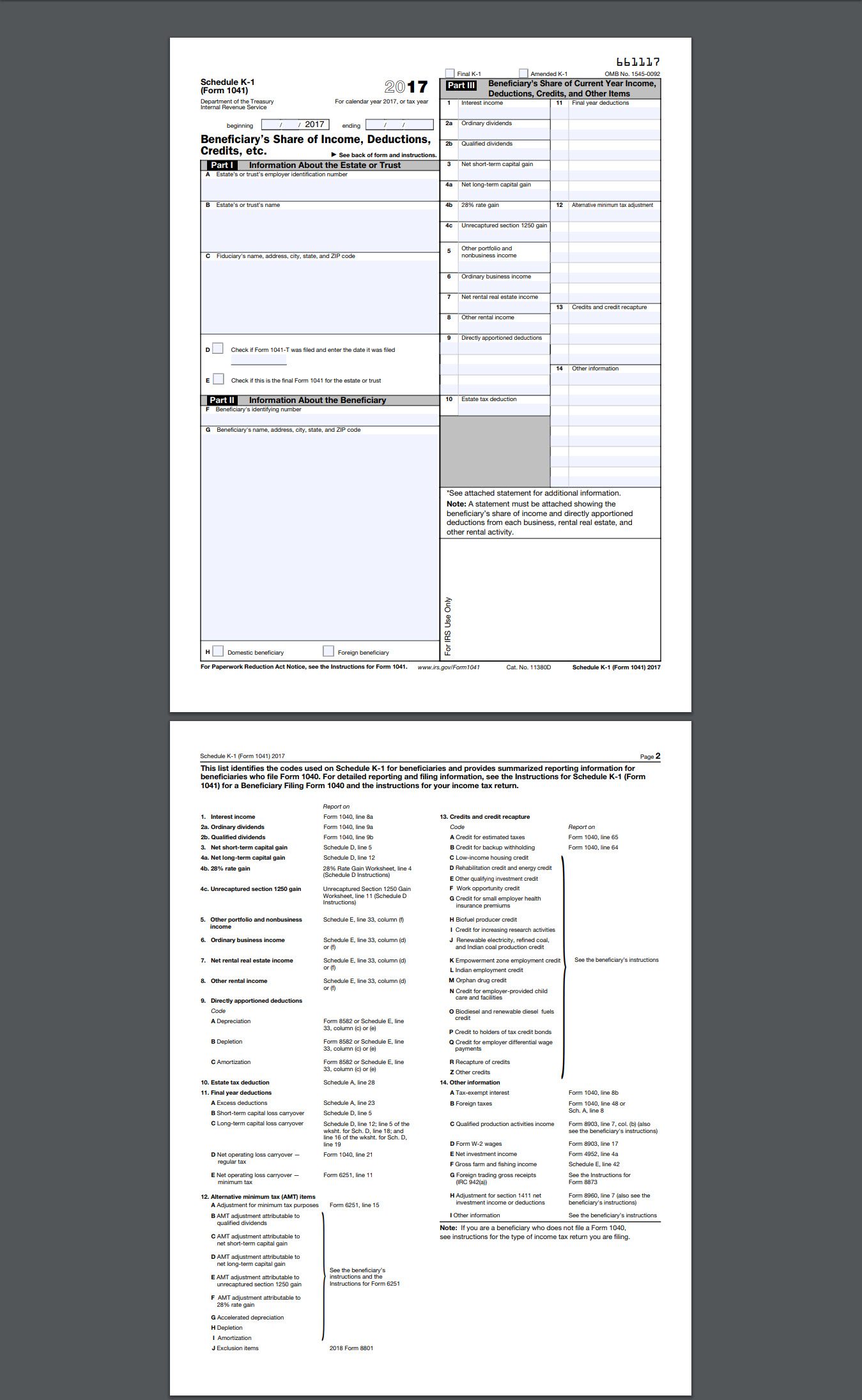

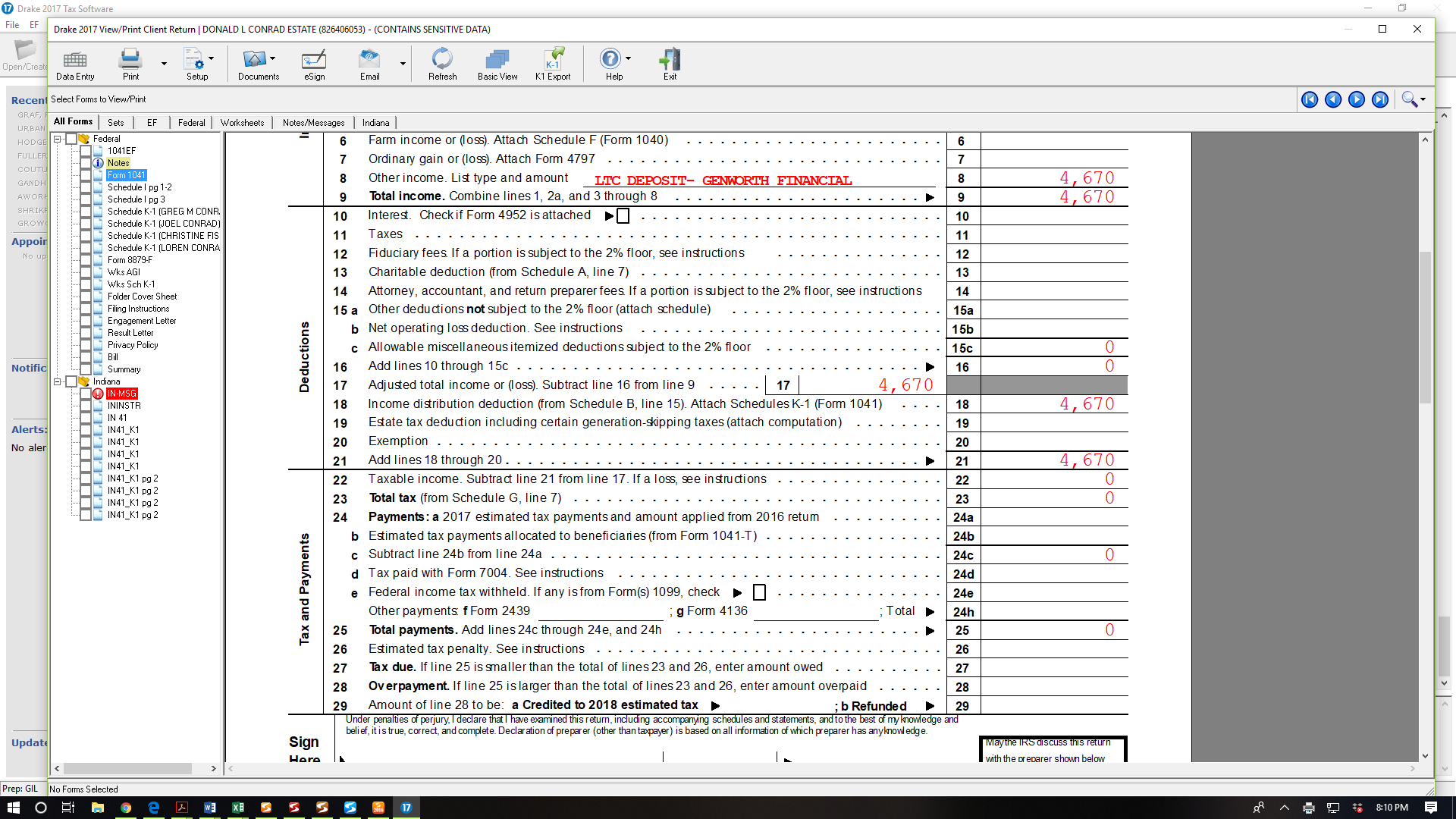

My dad had an estate set up. The only funds that passed thru it were one deposit for $4,670.16 from Genworth Financial which was for the reimbursement for the final partial month of care at Hubbard Hill that we paid for. The way his LTC policy worked was that we paid the bill at Hubbard Hill and then Genworth reimbursed the daily policy max amount. The funds were withdrawn and split equally between myself and my three siblings in September. We each got $1167.54. Does a K-1 still need to be issued to each sibling?

How It Works

Get an answer in three easy steps. Here's how it works...

1. Ask Your Question

Enter your tax preparation question at the top of this page and click Get An Answer.

2. Pick Your Priority

Tell us how quickly you want your tax preparation question answered.

3. Get An Answer

Connect with your tax preparer via online chat or telephone call.