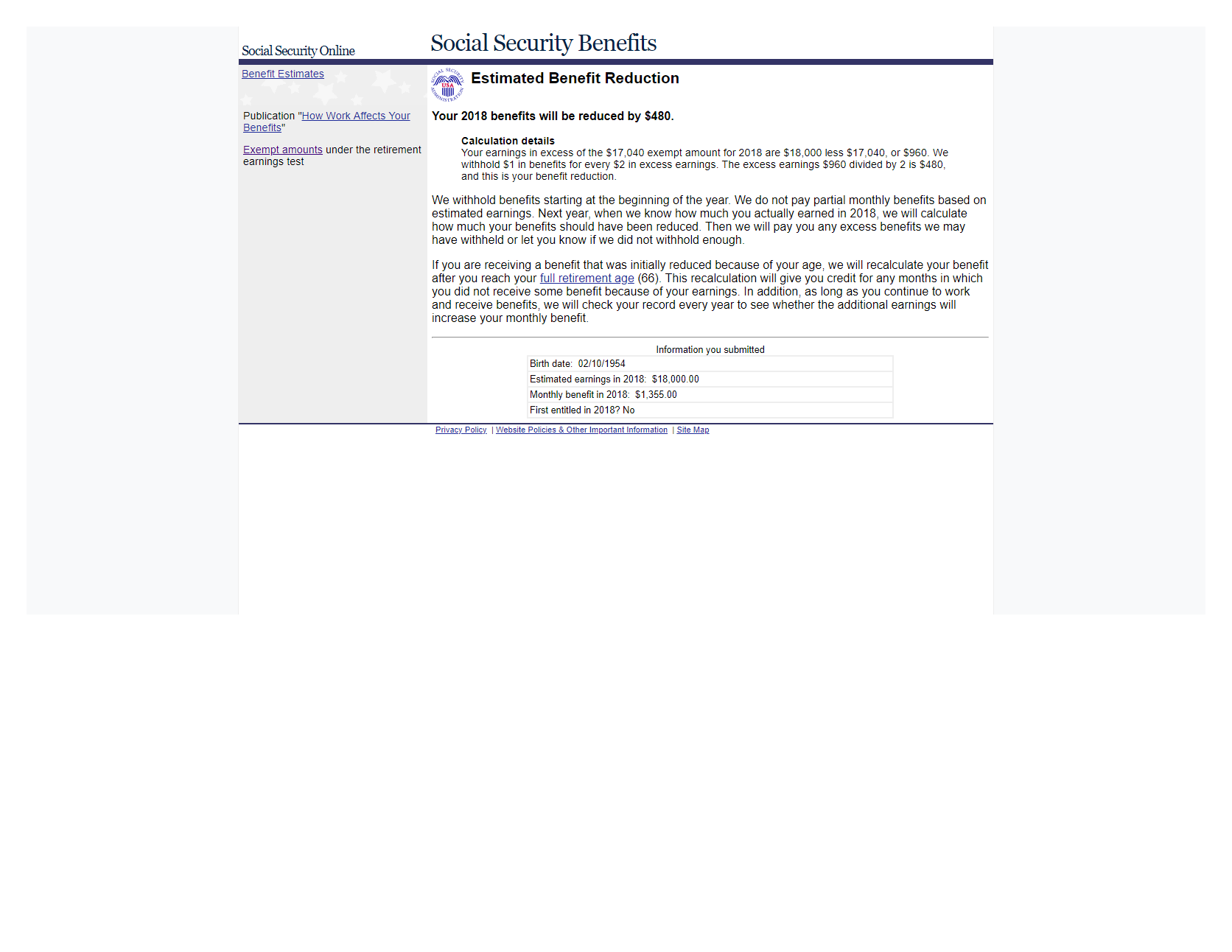

I just received a letter from Social Security saying I will not receive 2019 benefits because I work. I will only make $18,000 in 2019. Can they withhold my benefits and what should I do about this. I have 60 days to respond if I disagree with this.

How It Works

Get an answer in three easy steps. Here's how it works...

1. Ask Your Question

Enter your Social Security question at the top of this page and click Get An Answer.

2. Pick Your Priority

Tell us how quickly you want your Social Security question answered.

3. Get An Answer

Connect with your Social Security advisor via online chat or telephone call.