Daniel,

Depends on how many tax forms (K-1) the partnership sends you. Most of the time if you invest in one Partnership, as a limited partner, you will receive one K-1 and all the information relating to the tax year (Income And Distributions). Your original investment will be your original basis (your cost of buying into the partnership). The K-1 will separate the part of the distribution on your as return of investment (not taxable) and all your taxable income / losses.

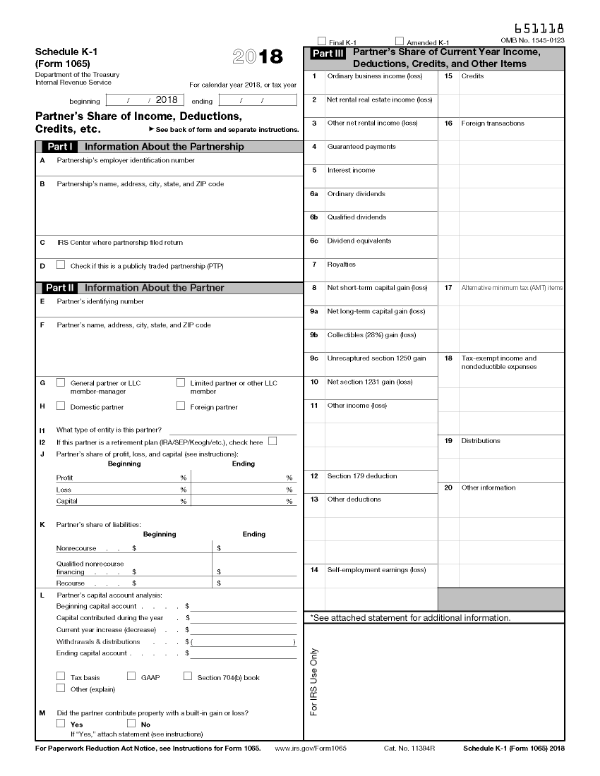

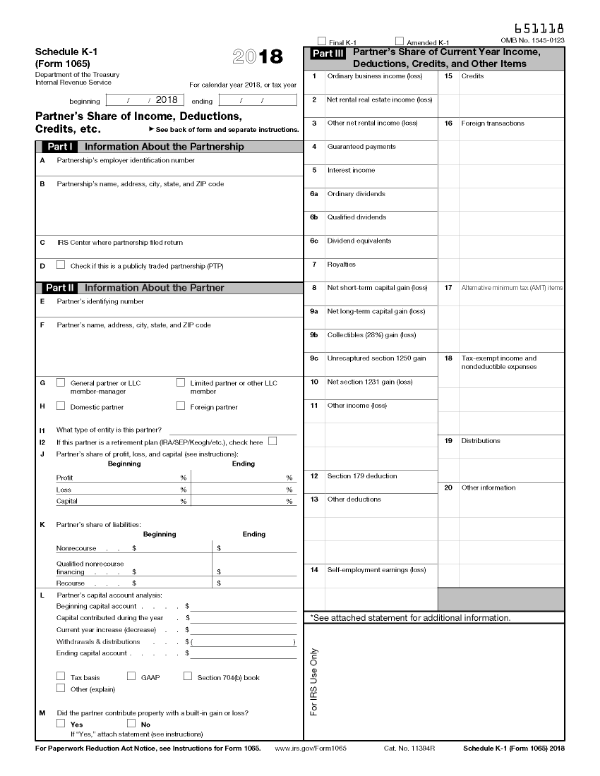

I am providing the following to explain form K-1

Schedule K-1

What is the Schedule K-1

A Schedule K-1 is a tax document used to report the incomes, losses and dividends of a business's partners. The Schedule K-1 document is prepared for each individual partner and is included with the partner’s personal tax return.

Schedule K-1

BREAKING DOWN Schedule K-1

The tax code in the United States allows the use of certain pass-through taxation, which shifts tax liability from the entity (trust, corporation) to the individuals who have an interest in it. This is where the Schedule K-1 comes in. While not filed with an individual partner’s tax return, the financial information posted to each partner’s Schedule K-1 is sent to the IRS with Form 1065. Income earned from partnerships is added to the partner’s other sources of income and entered in Form 1040.

Basis Calculation

The Schedule K-1 requires the partnership to track each partner’s basis in the partnership. Basis refers to a partner’s investment in the enterprise. A partner’s basis is increased by capital contributions and the partner’s share of income, while basis is reduced by a partner’s share of losses and any withdrawals.

Assume, for example, that a partner contributes $50,000 in cash and $30,000 in equipment to a partnership, and the partner’s share of income is $10,000 for the year. The total basis is $90,000, less any withdrawals taken by the partner. The basis calculation is important, because when the basis balance is zero, any additional payments to the partner are taxed as ordinary income. The basis calculation is reported on Schedule K-1 in the partner’s capital account analysis section.

Income Reporting

A partner can earn several types of income on Schedule K-1, including rental income from a partnership’s real estate holdings and income from bond interest and stock dividends. Many partnership agreements provide guaranteed payments to general partners who invest the time to operate the business venture and those guaranteed payments are reported on Schedule K-1. The guaranteed payments are put in place to compensate the partner for the large time investment. A partnership may generate royalty income and capital gains or losses and those items are allocated to each partner’s Schedule K-1, based on the partnership agreement.

Victor Santucci EA